Tarfin raises $5M Series A for its smallholder lending app!

Our first portfolio company Tarfin, the agriculture fintech startup based in Turkey, has raised $5 million in its Series A investment round with participation from Wamda.

Founded in 2017 by Mehmet Memecan, Tarfin provides farmers with access to agricultural inputs at affordable prices and payment terms by combining traditional supply channels with technology and financial resources. While strengthening its balance sheet with the new capital, Tarfin plans to accelerate its investments in data science, mobile technology and team with the aim of reaching more farmers in Turkey and Eastern Europe.

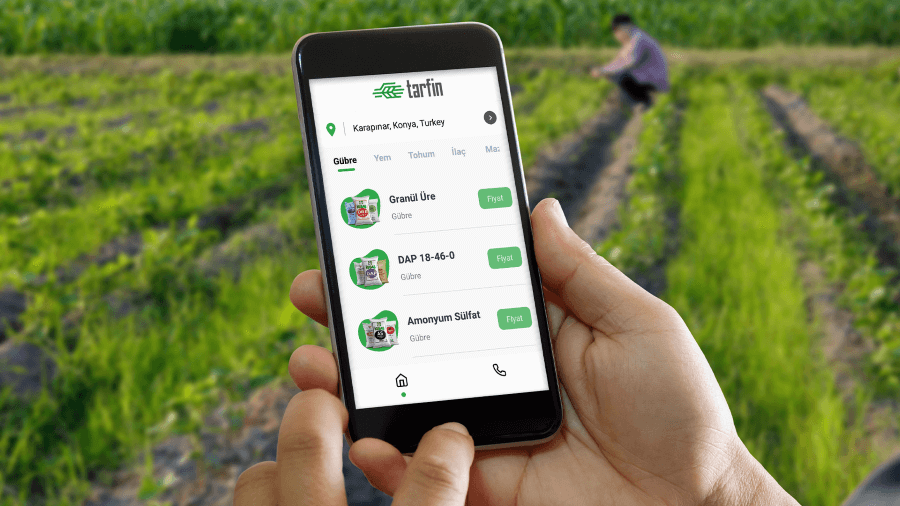

Tarfin, with its machine learning based agricultural risk scoring model, ensures that farmers reach all the agricultural inputs needed today with reasonable prices and extended payment terms. Tens of thousands of farmers reduce input costs by shopping for their inputs at Tarfin’s more than 240 partner sales points. Tarfin aims to combine the entire process from product price comparison to purchase in its new mobile application, and continues to provide services to more farmers by using its technological infrastructure and wide sales network.

The pandemic that changed the balance of the period we live in has once again revealed the importance of agriculture. As Tarfin, we have always made it a mission to find new solutions for our farmers. Our farmers are devoted to ensuring the continuity of production. As the private sector, every step we take for our farmers today will bring a stronger economy, a healthier future and a more sustainable production tomorrow. Thank you to our new partners who support the sustainability of agriculture.

Mehmet Memecan, Founder and General Manager

The round was led by global fintech fund Quona Capital, Raiffeisen Bank’s venture capital fund Elevator Ventures, one of the world’s largest producers of agricultural inputs, Collective Spark and Syngenta’s venture capital fund Syngenta Ventures. Tarfin had previously raised a $1.3 million seed round in 2018 led by Collective Spark with co-investment from Wamda.

-Source: Magnitt